To analyze cryptocurrency charts and forecast future asset performance, traders employ a variety of indicators. Volatility, momentum, volume, and, in most cases, trends can all be used as technical analysis indicators.

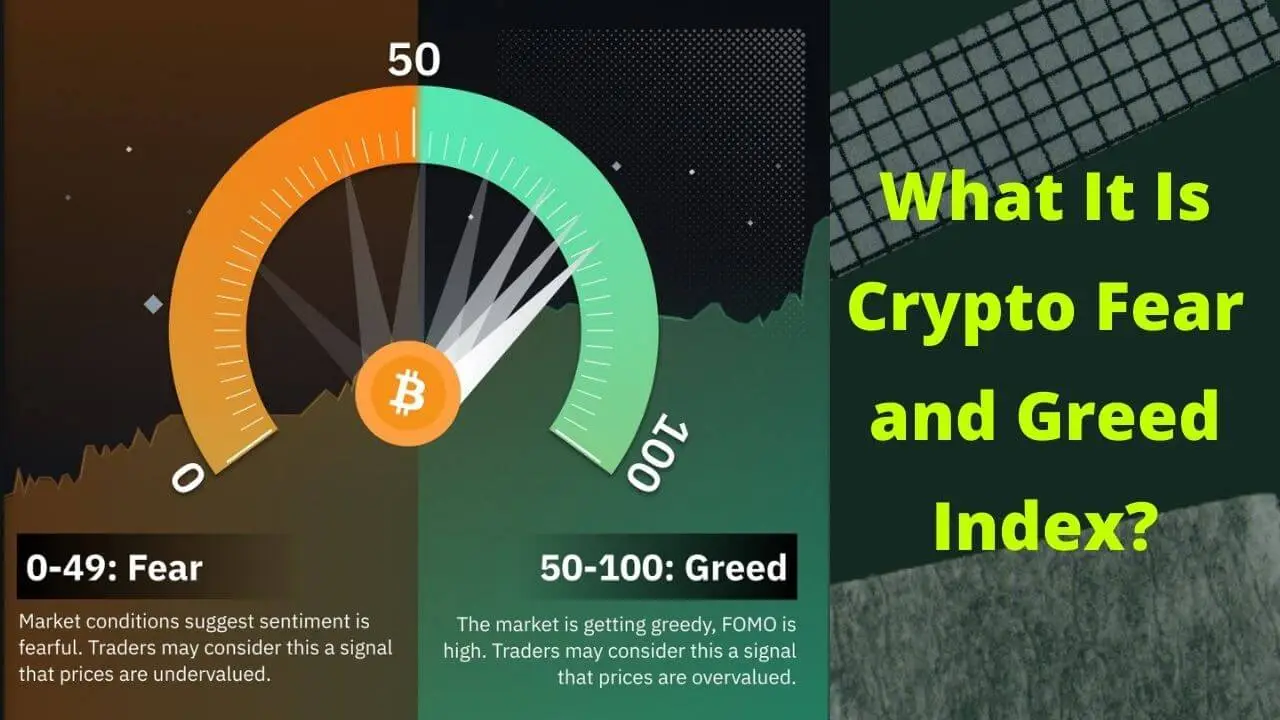

The Fear and Greed Index is a popular trend indicator among crypto investors. The Crypto Fear and Greed Index calculates the market’s sentiment, which is expressed as a score between 0 and 100.

Fear is represented at the lower end (0–49), while greed is represented at the upper end (50–100).

Using standard market psychology, we determine that greed is a period when an asset is overbought. Fear is oversold when it is present.

In the first case, we have a scenario in which the asset is likely to be rejected and lose value, whereas fear has the opposite effect.

As a result, we can conclude that the Fear and Greed Index can be used to determine when to enter and exit the market as part of a trading strategy.

Learn How To Trade Cryptocurrencies Like A Pro.

Table of Contents

Introduction

A good trader or investor will always look for supportive data when deciding whether to buy in or sell out of the crypto market. There are graphs to study, fundamentals to consider, and market sentiment to consider.

Examining every metric and index available, on the other hand, isn’t the most efficient use of time. A combination of sentiment and fundamental metrics provides a glimpse of market fear and greed with the Crypto Fear and Greed Index.

While you should not rely solely on this indicator, it can assist you in determining the general mood of the cryptocurrency markets.

What is an index?

An index is a statistical measure that takes multiple data points and combines them into a single statistic.

The Dow Jones Industrial Average (DJIA) is a well-known stock market index that you may have heard of.

The DJIA is a price-weighted index that consists of 30 large companies that are listed on various stock exchanges across the United States. Traders and investors can purchase DJIA to gain exposure to the stocks of these companies.

The Crypto Fear and Greed Index is a weighted measure of market data as well, but the similarities end there.

The Crypto Fear and Greed Index, like any other financial instrument, is not available for purchase. It’s just a market indicator to help you with your research.

What is a Market Indicator?

Market indicators simplify the analysis of market data for traders and investors. Indicators are used in all three types of market analysis: technical, fundamental, and sentiment.

If you’ve dabbled in technical analysis (TA), you’re probably already familiar with indicators. These can be as simple as moving averages or as complex as Ichimoku Clouds.

The purpose of the TA indicators is to analyze prices, trading volumes, and other statistical trends.

Indicators of fundamental analysis take a different approach. When you conduct research on a token or stock, you are attempting to ascertain the project’s underlying fundamental value.

For instance, your research could incorporate both the number of users and the total market value into a single indicator.

What is the Crypto Fear and Greed Index?

The Fear and Greed Index measures investors’ attitudes toward the markets. This index determines whether the markets are bullish or bearish and is built on two opposing emotions: fear and greed.

When market conditions are extreme, investors can be irrational. For example, when the market is down, investors are fearful, and when the market is up, they are greedy.

Understanding investors’ emotions provides an opportunity for investors to profit. Famous investor Warren Buffett advises, “Be fearful when others are greedy, and greedy when others are fearful.”

How the Crypto Fear and Greed Scale Works

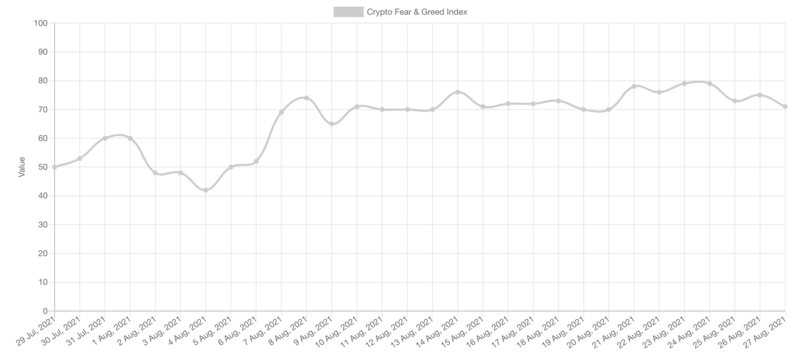

The Crypto Fear & Greed Index goes from 0 to 100, and it shows how scared or excited people are about crypto. Lower scores show more fear in the market, while higher ones show that greed is taking over.

Extreme fear is a score between 0 and 24, but between 25 and 49, it’s just called “fear.” As you might expect, 50 is about in the middle. Greed can be found in the market with a score of 51 to 74, and it can get even worse with a score of 75 or more.

It can be a good time to buy when the index shows extreme fear. Many people are selling, which drives prices down, which can be a good time to buy.

Extreme greed can make FOMO a great time to make money by selling at the top of the market and making money.

In other words, be careful about using the index to predict how the market will go. This is a bad idea that many smart investors tell people not to do.

The Crypto Fear and Greed Index is based on CNNMoney’s stock market Fear and Greed Index, and there are lessons to be learned about the risks of profit-taking and the value of buying and holding.

As of August 2020, Fidelity looked at a $10,000 investment in the S & P 500 that took place from 1980 to the end of the year. More than half of the value of that investment was lost if only the best 10 days were missed.

What Does the Crypto Fear and Greed Index Measure?

Alternative.me took CNN’s advice and came up with a fear and greed index for Bitcoin. The concepts are the same, but the way they are shown is different.

This index could be used to figure out how investors feel about Bitcoin. It could also be used to figure out how people feel about other cryptocurrencies.

is scored from 0 to 100. 0 is a sign of extreme fear, which means that investors are very pessimistic about the future of Bitcoin. 100 is a sign of extreme greed, where investors are too confident.

When the price of crypto goes up or down, this index can be used to tell you when it’s time to buy or sell.

The Crypto Fear and Greed Index looks at six things. The indicators in this index are made up of a mix of quantitative and qualitative data.

Volatility (25%)

Using volatility, you can see how volatile Bitcoin is right now and how much it can go down. This compares to how volatile it has been in the last 30 and 90 days.

Volatility may rise sharply when the market is afraid, which could be a sign that it is.

Market Momentum/Volume (25%)

It takes the amount of Bitcoin in the market and how quickly it’s moving, and then compares it to how it’s been doing over the last 30 and 90 days.

When the upward momentum is strong, this could mean that the market is going to be going up.

Social Media (15%)

The social media indicator uses sentiment analysis based on likes, posts, and hashtags from Twitter to figure out how people feel.

If there are a lot of measured interactions in a short time, the market might be greedy.

Dominance (10%)

Dominance is a measure of how much market capitalization Bitcoin takes up from the total market capitalization of all the other cryptocurrencies out there.

Bitcoin has a bigger share of the market than altcoins, which could mean that investors are less interested in them.

Trends (10%)

Trends looks at how often people search for Bitcoin-related terms on Google. It looks at how many people search for a word or phrase, and how many people have been told about it by well-known sites.

Surveys (15%) – Currently paused

Weekly polls are done on a polling platform to find out what people think about the markets.

Indicators like these show how volatile and how quickly the markets move. Qualitative scores make up the rest of their scores. The Bitcoin Fear and Greed index is different from the original Fear and Greed index, but both indices measure how we feel about the markets. Investors can use this index to find out how the market is doing.

Neither the equity nor the crypto markets are stable. There is no single measure that can be used to accurately measure them. An investor should always use a wide range of market metrics when making decisions.

Learn How To Trade Cryptocurrencies Like A Pro.

Related Question And Answer

What is fear Crypto?

The crypto version, which was made by alternative.me, tries to figure out if traders are too bullish (represented by greed) or too bearish (represented by fear). It also takes into account social media trends and Google search terms.

What is Bitcoin fear index?

CNN Money has come up with its own fear and greed index based on a lot of different things. The alternative The Me Index looks at the current mood in the Bitcoin market and turns the numbers into a visual scale that goes from 0 to 100: 0 is “Extreme Fear,” and 100 is “Extreme Greed.”

What is fear price?

In the last 24 hours, Fear’s price was 1.88 USD, and there was 9.88 M USD worth of Fear traded. In the last 24 hours, FEAR went up 0%. When FEAR is in use, it has a supply of 6.53 M of FEAR and a maximum supply of 65.00 M of FEAR at all times.

What is the total supply of fear?

Fear Price

| Circulating Supply | 6,532,157 FEAR |

|---|---|

| Total Supply | 65,000,000 FEAR |

| Max Supply | 65,000,000 FEAR |

Closing Thoughts

Nobody can predict the future on their own, and no indicator can do that. There are a lot of indicators that can help traders stay successful and make money on their journey, but they should also use their technical analysis knowledge.

So, each trader has to be their own judge and come to a rational conclusion on their own. Two people can read the same data and come to different conclusions.

The Crypto Greed and Fear Index is usually used to look at short-and medium-term price predictions because it changes so quickly.

It’s not recommended to use it for long-term price predictions because the indicator changes quickly and can be affected by new things.