Credit cards are a ubiquitous part of modern financial life, offering convenience, flexibility, and numerous perks. The Wilco Credit Card is a noteworthy addition to this landscape, designed to provide cardholders with a versatile and rewarding financial experience while fostering a connection to Wilco, a well-known retail and agricultural cooperative. In this article, we’ll delve into the Wilco Credit Card, its key features, the benefits it offers, and its unique connection to Wilco.

Table of Contents

The Wilco Credit Card: A Collaboration with a Trusted Brand

The Wilco Credit Card is a co-branded credit card offered in partnership with Wilco, a widely recognized cooperative specializing in farm and garden supplies, fuel, and a variety of products and services. This partnership allows cardholders to enjoy a unique blend of financial advantages while demonstrating their support for Wilco.

Key Features and Benefits of the Wilco Credit Card

- Reward Programs: Many Wilco Credit Cards come with rewards programs that allow cardholders to earn points, cash back, or other benefits on their purchases. These rewards can be redeemed for a range of options, including statement credits, travel, merchandise, or gift cards.

- Low Introductory APR: Some Wilco Credit Cards may offer a low introductory annual percentage rate (APR) on purchases and balance transfers for a specified period, which can be advantageous for cardholders looking to manage their finances efficiently.

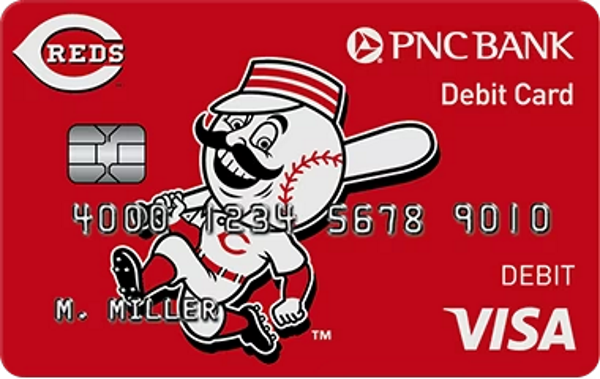

- Customized Card Designs: Cardholders often have the option to personalize their Wilco Credit Card by choosing a unique design, image, or photo. This not only makes the card special but also allows cardholders to proudly display their affinity for Wilco.

- Online Account Management: Wilco Credit Cards offer convenient online account management, enabling cardholders to access their accounts, view transactions, check balances, make payments, and set up account alerts from the convenience of their digital devices.

- Security Features: Wilco prioritizes the security of cardholders by providing advanced fraud protection, zero-liability policies, and real-time transaction alerts. These security measures offer peace of mind by safeguarding cardholders from potential unauthorized transactions and fraudulent activity.

- Flexible Payment Options: Cardholders can choose from various payment options, including setting up automatic payments or scheduling payments to align with their financial preferences and due dates.

- Additional Perks: Depending on the specific Wilco Credit Card, cardholders may enjoy extra benefits such as travel insurance, extended warranties on purchases, purchase protection, and access to exclusive events or discounts.

How to Apply for a Wilco Credit Card

Applying for a Wilco Credit Card typically involves the following steps:

- Research and Compare: Begin by researching and comparing the various Wilco Credit Cards available. Consider factors like rewards programs, introductory APR offers, fees, and perks to determine which card aligns with your financial goals and lifestyle.

- Visit the Issuer’s Website: After selecting the Wilco Credit Card that suits your needs, visit the website of the credit card issuer.

- Complete the Application: Fill out the online application form, providing the necessary personal and financial information.

- Credit Check: The credit card issuer will review your application and conduct a credit check to assess your creditworthiness.

- Wait for Approval: You will receive a response regarding your Wilco Credit Card application, which will either be an approval or a decline.

- Receive and Activate the Card: If your application is approved, you will receive the Wilco Credit Card by mail. Follow the issuer’s instructions to activate the card.

- Start Using the Card: Once activated, you can begin using your Wilco Credit Card for purchases and enjoy any applicable features, benefits, and rewards.

Conclusion

The Wilco Credit Card offers a unique combination of financial convenience and a connection to the trusted Wilco brand, making it a valuable addition to cardholders’ financial portfolios. With rewards programs, low introductory APRs, customizable card designs, and a range of security features, it provides a well-rounded financial experience. If you’re looking for a credit card that not only enhances your financial life but also allows you to proudly display your affiliation with Wilco, consider applying for a Wilco Credit Card and enjoy the benefits it brings to your financial journey.